Netflix falls short of expectation as market approaches post-peak stream, according to GlobalData

May 12, 2022

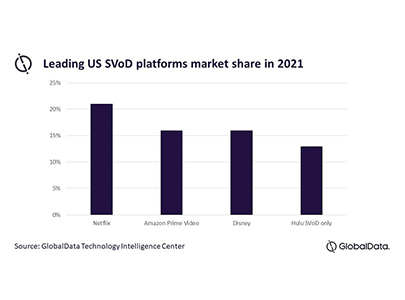

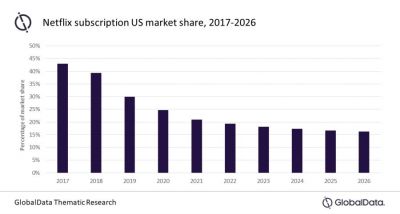

Netflix is clearly losing dominance in the subscription video on demand (SVoD) market, according to GlobalData. The leading data and analytics company notes that the streaming company’s market share in the U.S. was 25%, and this will fall to 16% by 2026.

“It is clear that we are now post-peak stream as life goes back to normal," Charlotte Newton, Thematic Analyst at GlobalData, said. "Streaming services are either throwing money at the problem, chasing a dwindling number of subscribers, or (in Netflix’s case) cutting back on content spend, which was its USP. Streaming services need to adjust expectations, and improve their offerings to prevent further haemorrhaging of subscribers and to compete in an increasingly fragmented SVoD market.”

Newton continues, “People are feeling the pinch with rising cost of living and must be more selective about what they choose to spend their money on. Subscription-based streaming services are just one example of where people may choose to cut costs to make ends meet. It is not just Netflix taking a hit. Disney + cancellation rates have tripled since the beginning of 2022, compared to Q4 2021.

“Streaming services are seen as a luxury. Fewer people will want to have more than one subscription, and will base their decision on content offerings. Netflix have delivered well on this front, with hits like Bridgeton, Ozark, and the Adam Project. However, what keeps many viewers is the ability to rewatch favourites like Friends over and over again. The streaming service facing strong competitors who are more willing to spend on content and buy fan favourites. In essence, they will have to diversify their offerings, produce quality content and keep the classics, to be considered worth the monthly spend.”

“Amid tumbling subscriber numbers, Netflix finds itself in an entirely different landscape to its pandemic heyday," Francesca Gregory, thematic analyst at GlobalData, said. "Netflix is considering shifting to ad-based models and cracking down on account sharing. Although this would improve revenues, these shifts will potentially compromise user experience, which has been a central tenet to Netflix’s past success. Netflix risks losing its point of differentiation in the increasingly crowded streaming market. As the cost-of-living crisis bites and competition intensifies, Netflix will need to balance revenues with a seamless user experience; or it could witness a mass exodus of subscribers from the platform.”

ABOUT GLOBALDATA

Four thousand of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.