Monetize your digital audience

Oct 20, 2020

MATTHEW LULAY

Publishers around the world have been aggressively pursuing digital subscriptions over the past several years as shifting consumer preferences, a secular decline in print demand, and challenges to print delivery continue to mount. Coupled with the significant increase in the demand for news as a product of the pandemic, digital subscription volumes are substantially higher than a year ago for most publishers.

As digital subscribers become a larger proportion of total circulation, the ability of markets to monetize these subscriptions is paramount to the long-run sustainability of local and national news outlets alike. While publishers have been hesitant to increase rates on digital subscribers in an effort to drive revenue, Mather Economics’ research suggests significant revenue opportunity exists for publishers willing to assume intelligent pricing initiatives without sacrificing digital subscription volume.

Below, we will briefly review some of the findings from recent digital pricing initiatives that publishers have undertaken in partnership with Mather and provide some recommendations and considerations for publishers to evaluate as they begin down the pricing path for their own digital subscriptions.

DIGITALS GROWING IMPORTANCE

As mentioned, for most publishers, digital subscriptions are making up a larger proportion of overall volume than ever before.

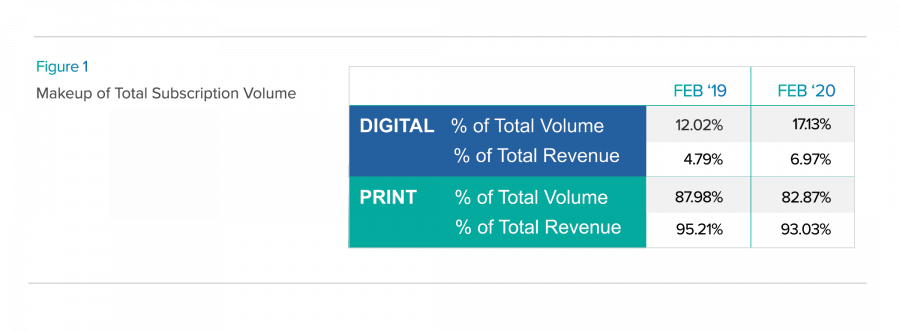

According to Mather’s internal subscription database, from February 2019 to February 2020, digital subscribers grew from 12.02% to 17.13% of overall circulation volume. In addition, from March 2020 to April 2020, that percentage grew almost another full percentage point from 18.53% to 19.37%. Figure 1 shows the average makeup of total volume and revenue year over year.

Machine learning models estimating propensity to subscribe will test the predictive power of many variables, typically 50 or more, to see which customer attributes and behaviors are most important to the likelihood of subscribing. These variables include engagement metrics, such as visits, page views, article page views, unique days, time on site, scroll depth and content breadth.

The models also include location variables, device information, day part and day of the week, content preferences, paywall interactions, deviations from behavioral patterns and ratios such as page views per visit.

While digital volumes have been a growing piece of the volume pie for publishers, the revenue contribution from these subscribers has not kept pace. In fact, while digital accounts made up 17% of total volume earlier this year, this group made up less than 7% of total revenue, showcasing the dramatic differences in rate between print and digital subscribers.

As print volume declines continue at 10+% annually, publishers will need to shift a larger share of the revenue contribution to digital subscribers with efficient pricing strategies.

PRICE SENSITIVITY FOR DIGITAL SUBSCRIBERS

Many subscription leaders have been hesitant to increase subscription rates on digital subscribers for several reasons, including assumptions that pricing will hamper strategic goals of aggressive growth in digital volume and that digital subscribers are more price sensitive than their print peers. Fortunately, some publishers have been conducting pricing tests with Mather over the past year to address those assumptions with interesting results.

For the purpose of this study, we have aggregated the pricing results from four major U.S. publishing companies. The chart in Figure 2 shows the effective price elasticity for print and digital customers for each group. Price elasticity is defined as the change in volume as a function of a change in price. We are able to measure this via a robust A/B testing protocol, where stops due to price can be separated from organic churn with the holdout of a no-increase control group. To help interpret the values, an elasticity of 0.1 would imply a 10% change in price would result in a 1% loss in volume. Generally speaking, an elasticity below one (1) is considered inelastic, meaning a smaller percentage of volume is expected to be lost for the same level of price increase.

As you can see in the chart, for both print and digital channels across all groups, the elasticities are well below one, indicating an inelastic response to pricing. Of particular interest is that in three out of four groups, the digital elasticities are not only low, but they are lower than those measured for print subscribers in the same markets. For context, the tests were undertaken only on digital accounts with at least six months of tenure with starting rates ranging from $1.68 per week to $3.99 per week, and increases ranging from 16% to 100%. In all four cases, the pricing tests proved to be quite successful by proving rate increases on digital subscribers could drive revenue with minimal impact to volume across a range of starting price points and increase levels.

IMPLEMENTATION STRATEGIES

Once publishers decide that a digital rate increase is likely to provide incremental value, they are faced with several options for implementation. The most common of those options are individual, segment and product level implementations and are detailed in Figure 3.

Each of these options come with trade-offs between simplicity and precision. Using data analysis techniques to measure price elasticity at the individual level can lead to very precise rate recommendations to optimize revenue, but it requires more rates to be created and an investment in sophisticated analysis. This type of application accounts for individual level attributes that are associated with retention and price sensitivity.

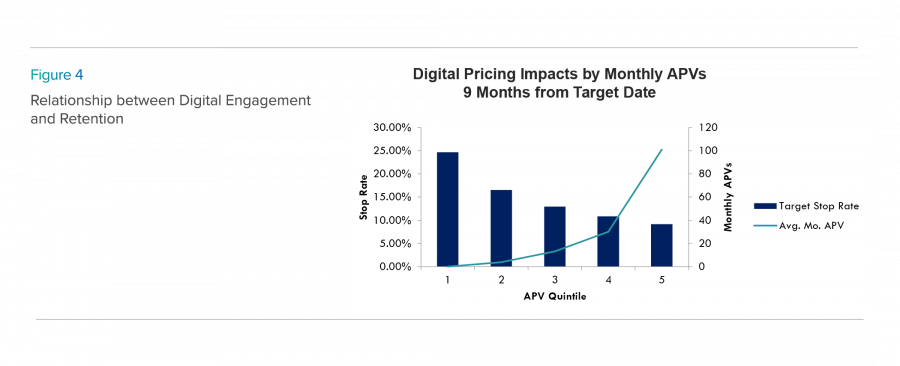

One of the most important attributes in predicting retention and price response with digital subscribers is engagement. Figure 4 shows the relationship between the stop rate of digital subscribers by level of monthly article page views (APVs) for one of the publishing groups alluded to previously.

Once measured, these types of individual nuances can be incorporated into an efficient pricing program to reduce negative volume impacts. The table in Figure 5 shows the potential revenue opportunity of applying this type of analytically-driven pricing program on a sample market with 10k digital accounts. We find that leveraging econometric analysis to apply differentiated pricing, or market-based pricing (MBP) can lower effective price sensitivity by 40% or more versus across the board (ATB) increases. In this example scenario, this strategy could generate an additional $172k annually and reduce volume loss by 6%.

On the other end of the spectrum, applying pricing at the product level allows for a lean rate structure but will often lead to underpricing a significant portion of the market that are not sensitive to price and pricing out the segment of the market that are highly sensitive to price. In between the two extremes are a range of implementation options of pricing at segment levels of the population.

In conclusion, as digital subscribers continue to garner a larger share of total volume, the need to monetize these audiences will become increasingly important. As we have seen, recent pricing tests have shown that digital subscribers exhibit low price sensitivity, indicating significant revenue opportunity through pricing action. Leveraging analytics tools to incorporate subscriber or segment level attributes to further refine pricing initiatives can further increase the efficacy of pricing programs.

At Mather, we have helped publishers design efficient pricing programs for print audiences for many years, and we look forward to continuing to expand these services to digital audiences as well.

Download article in PDF format.

For questions, feel free to reach out to matthew@mathereconomics.com.