Calculating your purchase price

Feb 1, 2026

STEVE FLOYD

President | Business Valuation Consulting LLC

From the seller’s view, the value of their publication(s) is usually not as high as they would like. Now, the industry uses a lower percentage of revenue or a lower multiple of cash flow. Sometimes these multiples can be as low as 25% of revenue or two times the cash flow.

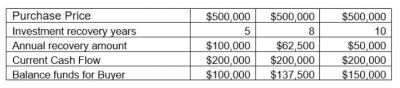

From the buyer’s view, these types of calculations are how they would determine the purchase price. Depending on the type of loan, security of a loan, or buyer’s return on investment needs, the most typical time periods are 5, 8 and 10 years. (Note: If real estate is involved, the terms could be longer, or at least the repayment terms for the real estate are normally longer.)

Unfortunately, in today’s market, bank loans and SBA loans are very hard to get for the print industry. To secure one requires a very good profit margin.

The calculation I use as a business broker to validate a sales price is below:

Current revenue is $950,000.

Current cash flow is $200,000.

Assuming the multiple is 2.5 times cash flow, which is $500,000, to determine a price using the $500,000 as a return on investment, you can consider the following:

There could be other factors that affect the final sales price, but this is a good starting point.

For many buyers, buying a business in October allows enough time to agree on a sales price and work out any necessary lending funding or owner financing before the year ends.

Steve Floyd, president, Business Valuation Consulting LLC, can be reached at 769-229-4200 or bizvalconsulting@gmail.com